Summit Planners: Understanding the Terms in a Will

Farmmi Receives NASDAQ Notification Regarding Minimum Bid Requirements

Nullmax Showcases Comprehensive Autonomous Driving Solutions at Auto China 2024

Pierre Fabre Laboratories receive positive CHMP opinion for OBGEMSA™(vibegron) in overactive bladder syndrome

United Imaging Healthcare Releases 2023 ESG Report, Advancing Mission of Equal Healthcare for All™

United Imaging Healthcare releases 2023 annual report, with revenue growth of 23.52%

New President Appointed for Nitto Denko Avecia Inc.

The World Perfumery Congress (WPC) Heads to Geneva, Switzerland in June

Ractigen Therapeutics Announces FDA Approval for RAG-01, a First-in-Class saRNA Therapy for BCG-Unresponsive NMIBC

Novel T-cell engager, CDH17 X CD3 cabotamig (ARB202) continues to explore dosing in patients with advanced gastrointestinal cancers

-

Driving Impact with AI: Brian Impact Foundation Joins AVPN Global Conference 2024

Brian Impact attends Asian Venture Philanthropy Network Global Conference 2024 to discuss foundation's AI-powered assistance system, 'BEES (Benevolence Enhancing Expert System)' Incorporating large language models, BEES enables effective data-driven decision-making Panel discussion on "Leveraging Artificial Intelligence for Philanthropic Impact" alongside global representatives from Wadhwani AI, Impact Intelligence, Tony Blair Institute for Global Change, and Micron Foundation SEOUL, South Korea, April 26, 2024 /PRNewswire/ -- Brian Impact Foundation recently attended Asian Venture Philanthropy Network (AVPN) Global Conference 2024 held in Abu Dhabi, the United Arab Emirates, and deliberated on the potential of Artificial Intelligence tackling societal challenges in transformative ways. Soomin Syd Kim, Project Director at Brian Impact, presents at AVPN Global Conference 2024 in Abu Dhabi During a panel session on April 23 titled "Leveraging Artificial Intelligence for Philanthropic Impact", Brian Impact introduced its AI-powered assistance expert system, 'BEES (Benevolence Enhancing Expert System)'. The foundation elucidated the development journey of BEES and showcased its implementation cases. Effectively incorporating large language models (LLMs), BEES is a groundbreaking philanthropic platform by Brian Impact that helps human experts identify more diverse innovators and changemakers. Utilizing BEES for data collection and analysis, the foundation ensures data-driven decisions that resonate with its mission and values across a varied spectrum of programs. The session featured a distinguished panel comprising global representatives from Wadhwani AI, Impact Intelligence, Tony Blair Institute for Global Change, and Micron Foundation. They shared their own case studies and insights, focusing on maximizing social impact through AI, encompassing topics such as data-driven decision-making and impact measurement. Soomin Syd Kim, Project Director at Brian Impact Foundation, spearheaded the foundation's presentation and commented, "BEES exemplifies the power of combining AI's technological prowess with social expertise to drive impactful philanthropic initiatives." She expressed gratitude for the valuable insights gathered from global impact leaders at the conference, noting their guidance in developing innovative AI-powered solutions for driving social change more effectively. AVPN, Asia's leading network for impact organizations, investors, and stakeholders with a social innovation mandate, has been hosting the annual AVPN Global Conference since 2013. The conference explores solutions to global socioeconomic issues and fosters collaboration across diverse social sectors, bringing together nonprofits, impact investors and corporations. This year's AVPN Global Conference 2024 took place April 23-25 in Abu Dhabi, themed "One Asia, One Future." About Brian Impact Foundation The Brian Impact Foundation, founded on June 1, 2021, operates under the conviction that technology can be a catalyst for positive change in our world. Our mission is to support innovators who leverage technology to make a meaningful impact and individuals who lead with integrity across various fields. Through a range of projects, research initiatives, and collaborative endeavors, we are committed to offering solutions to pressing societal issues and empowering people to effectively navigate the evolving technological landscape. In our pursuit of these objectives, we embrace the principle of "Big Bet Philanthropy." This approach drives us to seek out and provide substantial support to pioneering organizations with a vision to address the root causes of societal issues, with the ultimate goal of fostering lasting and sustainable social change. Brian Impact Foundation official website: https://brianimpact.org/en For Media Inquiries Please Contact: Edelman Korea Kim, Jordan / Supervisor / jordan.kim@edelman.comKim, Jeewan / Account Executive / jeewan.kim@edelman.com

-

Autoliv: Financial Report January - March 2024

STOCKHOLM, April 26, 2024 /PRNewswire/ -- (NYSE: ALV) (SSE: ALIV.sdb) Q1 2024: Broad based improvements Financial highlights Q1 2024$2,615 million net sales 5% net sales increase5% organic sales growth*7.4% operating margin7.6% adjusted operating margin*$1.52 EPS, 77% increase$1.58 adjusted EPS*, 76% increase Full year 2024 guidanceAround 5% organic sales growthAround 0% FX effect on net salesAround 10.5% adjusted operating marginAround $1.2 billion operating cash flowAll change figures in this release compare to the same period of the previous year except when stated otherwise. Key business developments in the first quarter of 2024 Record first quarter sales, increased organically* by 5%, which was 6pp better than global LVP decline of 1% (S&P Global April 2024). We outperformed in all regions, mainly due to new product launches and higher prices carried over from last year. Profitability improved substantially, driven mainly by organic growth and cost reduction activities. Operating income was $194 million and operating margin was 7.4%. Adjusted operating income* improved from $131 million to $199 million and adjusted operating margin* increased from 5.3% to 7.6%. Return on capital employed was 19.7% and adjusted return on capital employed* was 20.2%. Strong cash flow improvement. Operating cash flow improved by $168 million and free cash flow* improved by $171 million. The leverage ratio* of 1.3x was close to unchanged compared to three months earlier and 0.3x lower than a year earlier despite returning $0.7 billion to shareholders as dividends and share repurchases in the last 12 months. In the quarter, a dividend of $0.68 per share was paid, and 1.37 million shares were repurchased and retired. *For non-U.S. GAAP measures see enclosed reconciliation tables. Key Figures (Dollars in millions, except per share data) Q1 2024 Q1 2023 Change Net sales $2,615 $2,493 4.9 % Operating income 194 127 52 % Adjusted operating income1) 199 131 51 % Operating margin 7.4 % 5.1 % 2.3pp Adjusted operating margin1) 7.6 % 5.3 % 2.3pp Earnings per share2) 1.52 0.86 77 % Adjusted earnings per share1,2) 1.58 0.90 76 % Operating cash flow $122 $(46) n/a Return on capital employed3) 19.7 % 13.0 % 6.7pp Adjusted return on capital employed1,3) 20.2 % 13.4 % 6.8pp 1) Excluding effects from capacity alignments and antitrust related matters. Non-U.S. GAAP measure, see reconciliation table. 2) Assuming dilution when applicable and net of treasury shares. 3) Annualized operating income and income from equity method investments, relative to average capital employed. Comments from Mikael Bratt, President & CEOWe delivered record first quarter sales, outperforming global LVP growth by 6pp. We outperformed in all regions, including China despite a negative LVP mix development with domestic Chinese OEMs growing by 17% and global OEMs declining by 5%. It is encouraging that our sales in India grew organically by 27%. Sales in India are now larger than in South Korea, accounting for more than 4% of our global sales. We delivered results in line with what we previously communicated, despite LVP being 1pp below what was expected three months ago, and we are on track to deliver on our full year outlook. We expect a record number of product launches in 2024, despite some OEMs changing certain vehicle model launch plans, mainly for EV platforms. Profitability continued to improve significantly, driven mainly by volume growth and cost reductions. Restructuring activities are yielding results with indirect headcount declining by around 1,000, or by more than 5%, in the past 12 months. Our continued focus on balance sheet efficiency is supporting our strong performance for cash flow, cash conversion, and return on capital employed. I am particularly pleased with our leverage ratio of 1.3x, which declined significantly compared to a year ago, despite returning $0.7 billion to shareholders and investing in footprint optimization and growth. To support future growth, we are currently investing in increased capacity in Vietnam, China and India. We are facing inflationary pressure again this year and we continue to expect compensation for what is in excess of what we can offset through normal productivity measures. The discussions with our customers are progressing according to plan. As we have previously communicated, we expect the seasonality of past years to likely continue in 2024, with a gradual improvement throughout the year, leading to a full year adjusted operating margin* of around 10.5%. Key drivers for the full year margin progression are organic growth, our structural and strategic cost reduction initiatives, and a lower call-off volatility. The 2024 development we expect should set up a solid base towards a continued high level of shareholder returns and our target of around 12% adjusted operating margin*. Inquiries: Investors and AnalystsAnders TrappVice President Investor RelationsTel +46 (0)8 5872 0671 Henrik KaarDirector Investor RelationsTel +46 (0)8 5872 0614 Inquiries: MediaGabriella EtemadSenior Vice President CommunicationsTel +46 (0)70 612 6424 Autoliv, Inc. is obliged to make this information public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the VP of Investor Relations set out above, at 12.00 CET on April 26, 2024 This information was brought to you by Cision http://news.cision.com https://news.cision.com/autoliv/r/financial-report-january---march-2024,c3968759 The following files are available for download: https://mb.cision.com/Main/751/3968759/2763039.pdf The full report (PDF)

-

Yatsen Filed 2023 Annual Report on Form 20-F

GUANGZHOU, China, April 26, 2024 /PRNewswire/ -- Yatsen Holding Limited ("Yatsen" or the "Company") (NYSE: YSG), a leading China-based beauty group, today announced that the Company has filed its annual report on Form 20-F for the fiscal year ended December 31, 2023 with the U.S. Securities and Exchange Commission ("SEC") on April 26, 2024. The annual report is available on the Company's investor relations website at ir.yatsenglobal.com and on the SEC's website at https://www.sec.gov/. The Company will provide hard copies of the annual report, free of charge, to its shareholders and ADS holders upon written request. Requests should be directed to Investor Relations Department, Yatsen Holding Limited, Building No. 35, Art Port International Creation Center, No. 2519 Xingang East Road, Haizhu District, Guangzhou 510330, People's Republic of China. About Yatsen Holding Limited Yatsen Holding Limited (NYSE: YSG) is a leading China-based beauty group with the mission of creating an exciting new journey of beauty discovery for consumers around the world. Founded in 2016, the Company has launched and acquired numerous color cosmetics and skincare brands including Perfect Diary, Little Ondine, Pink Bear, Galénic, DR.WU (its mainland China business), Eve Lom, and EANTiM. The Company's flagship brand, Perfect Diary, is one of the leading color cosmetics brands in China in terms of retail sales value. The Company primarily reaches and engages with customers directly both online and offline, with expansive presence across all major e-commerce, social and content platforms in China. For more information, please visit http://ir.yatsenglobal.com/. For investor and media inquiries, please contact: In China: Yatsen Holding LimitedInvestor RelationsE-mail: ir@yatsenglobal.com Piacente Financial CommunicationsHui FanTel: +86-10-6508-0677E-mail: yatsen@thepiacentegroup.com In the United States: Piacente Financial CommunicationsBrandi PiacenteTel: +1-212-481-2050E-mail: yatsen@thepiacentegroup.com

-

Delta Recognized with the ENERGY STAR® Partner of the Year - Sustained Excellence Award for the 7th Year in a Row

Today also marks Delta's 9th consecutive recognition as ENERGY STAR® Partner of the Year TAIPEI, April 26, 2024 /PRNewswire/ -- Delta, a global leader in power management and provider of IoT-based Smart Green Solutions, is proud to announce its 7th recognition as the ENERGY STAR® Partner of the Year - Sustained Excellence award. These prestigious accolades, bestowed by the U.S. Environmental Protection Agency and the U.S. Department of Energy, underscore Delta's unwavering commitment to excellence and energy conservation. The commitment is demonstrated by the 29 million kilowatt hours of electricity saved for our U.S. customers with Delta's cutting-edge DC brushless motor ventilation fans shipped throughout 2023. "As we accelerate historic efforts to address climate change, public-private partnerships will be essential to realizing the scale of our ambition," said EPA Administrator Michael S. Regan. "I applaud this year's ENERGY STAR award winners for working with EPA to deliver a clean energy future that saves American consumers and businesses money and creates jobs." Alex Lee, Vice President of Fan and Display Systems at Delta Electronics (Americas), expressed, "We are elated to be honored once again by ENERGY STAR for our sustained excellence and commitment to providing innovative solutions that enable customers to reduce their environmental footprint and electricity costs. With an impressive array of 97 ENERGY STAR®-qualified ventilation fans, Delta Breez continues to champion indoor air quality (IAQ) enhancements and energy conservation efforts." Each year, the ENERGY STAR program recognizes a select group of businesses and organizations that have made outstanding contributions in the transition towards a clean energy economy. These winners are chosen from a vast network of thousands of ENERGY STAR partners. Delta has not only been honored with the ENERGY STAR Sustained Excellence award for 7 years in a row, but also with the Partner of the Year award for 9 consecutive years. Wilson Huang, General Manager of Fans and Thermal Management Business Group, Delta Electronics, Inc., said, "Delta is privileged to be bestowed by ENERGY STAR® for the 9th consecutive year. This acknowledgement serves as a testament to our continual endeavors in developing energy-efficient solutions that make positive impact on both our customers and the planet. Delta is resolute to advancing our mission of delivering sustainable solutions to empower customers to achieve their environmental objectives." Delta is dedicated to engineering solutions that not only meet but surpass existing energy efficiency standards. Delta Breez takes pride in offering ENERGY STAR-certified products, with some exceeding the efficiency requirements by over 315%. Out of the 106 ventilation fan models assessed in 2023, 92% have been acknowledged as ENERGY STAR qualified. Well recognized as a pioneer in switching power supplies and thermal management products, Delta has evolved its portfolio to encompass an array of innovative IoT-based smart energy-saving systems and solutions, which include industrial automation, building automation, telecom power, data center infrastructure, electric vehicle charging, renewable energy, energy storage, and displays. Delta's high-efficiency products and solutions delivered between 2010 and 2022 enabled over 39.9 billion kilowatt-hours of electricity savings for its customers worldwide, which is equivalent to a reduction of 21.05 million tons in CO2e emissions. About Delta Electronics (Americas) Delta Electronics (Americas) was established 38 years ago and has grown to over one thousand employees in the entire Americas region. Delta has offices, R&D centers, manufacturing, distribution and repair centers in multiple locations in the United States, Mexico and South America. In the U.S., operations are located in Fremont, Los Angeles, San Diego, Seattle, Austin, Dallas, Raleigh and Detroit to better serve its diverse customer base. Outside the U.S., Delta continues to expand its Americas operations in Mexico, Brazil and Canada. Delta Electronics (Americas) serves the IT, communications, industrial automation, renewable energy, lighting, power tool, automotive electric vehicle and other major industries. Products include power electronics, DC brushless fans, visual displays, industrial automation, networking products, electronic components, consumer products and energy efficient and renewable energy products. The company is always striving to define new ways to improve the energy efficiency of its products through advanced research and product development. For more information, please visit: www.delta-americas.com About Delta Delta, founded in 1971 and listed on the Taiwan Stock Exchange, is a global leader in switching power supplies and thermal management products with a thriving portfolio of smart energy-saving systems and solutions in the fields of industrial automation, building automation, telecom power, data center infrastructure, EV charging, renewable energy, energy storage and display, to nurture the development of smart manufacturing and sustainable cities. As a world-class corporate citizen guided by its mission statement, "To provide innovative, clean and energy-efficient solutions for a better tomorrow," Delta leverages its core competence in high-efficiency power electronics and its ESG-embedded business model to address key environmental issues, such as climate change. Delta serves customers through its sales offices, R&D centers and manufacturing facilities spread over close to 200 locations across 5 continents. Throughout its history, Delta has received various global awards and recognition for its business achievements, innovative technologies, and dedication to ESG. Since 2011, Delta has been listed on the DJSI World Index of Dow Jones Sustainability™ Indices for 12 consecutive years. In 2020, 2022 and 2023, Delta was also recognized by CDP with double A List for its substantial contribution to climate change and water security issues, and named Supplier Engagement Leader for its continuous development of a sustainable value chain for 6 consecutive years. For detailed information about Delta, please visit: www.deltaww.com

-

PATCHOULI BECOMES THE NEXT ADDITION TO SCENTAIR®'S UK HOME FRAGRANCE OFFERINGS

CHARLOTTE, N.C., April 26, 2024 /PRNewswire/ -- For 30 years, ScentAir® has been the global leader in scent marketing, delivering innovative customer experiences. Renowned for its pioneering work with The View from The Shard, ScentAir transforms spaces with innovative scent strategies and premium-quality fragrances and diffusers. ScentAir UK's new Patchouli fragrance features notes of tuberose, geranium and white patchouli over a base of amber, blonde woods and suede musk. Several of ScentAir's most popular professional fragrances are also available for UK homes, allowing people to enjoy their living spaces with the same fragrances that have defined luxury worldwide. Its newest addition to the curated library is a twist on an all-time favorite, Patchouli. With its bohemian and free-spirited roots dating back to the 1960s, Patchouli has recently experienced a resurgence in popularity with younger generations. ScentAir's Whisper HOME Patchouli fragrance combines the essence of tradition with modern notes to create a warm and inviting atmosphere for any home. "We're excited to add Patchouli to our successful collection of home fragrances for the United Kingdom," said Stephanie Soittoux, Manager of EMEA Marketing and eCommerce. "Our customers have been inquiring about the development of popular fragrance additions to our scent library - we firmly believe this contemporary Whisper HOME Patchouli fragrance is destined to become a cherished favorite, transcending generations with its timeless appeal." ScentAir's Whisper HOME Patchouli fragrance features sensual notes of tuberose and geranium blend with white patchouli and a base of amber, blonde woods and suede musk. Often described as soothing, spicy and earthy, Patchouli fills the air with the mystic fragrance of bohemian bliss. Notes of white patchouli bring the warmth of amber and the woodsy calm of suede musk. Sensual florals of geranium and tuberose lend their sweet perfume to a balanced sensorial experience. It's the otherworldly Patchouli scent of comfort, home and life's simple pleasures. Try Whisper HOME Patchouli in your home or business by visiting ScentAir.com. ScentAir: Trusted by Brands, Loved by Families About ScentAir: ScentAir Technologies, LLC., privately held and founded in 1994, provides best-in-class ambient scent marketing solutions to many of the world's most recognized brands. As the global leader in olfactory marketing, the Company creates memorable impressions for both small businesses and global enterprises, elevating their customer experience through the power of scent. Based in Charlotte, NC, USA, and corporate offices in the United Kingdom, France, Netherlands, China, Hong Kong, Japan and Australia. The Company's 525+ global team members service customers in 119 countries through its dedicated global supply chain and manufacturing operations in North America, Europe, and Asia. ScentAir is committed to the creation of customized scent strategies that boost clients' brand sentiments, customer loyalty, and sales. To learn more, go to ScentAir.com.

-

COSRX Launches Invisible Yet Powerful Ultra-Light Invisible Sunscreen SPF50 PA++++

SEOUL, South Korea, April 26, 2024 /PRNewswire/ -- From its much-loved Advanced Snail 96 Mucin Power Essence to The 6 Peptide Skin Booster Serum that have become TikTok sensations, COSRX is riding high on the success of several cult products that have won the approval of millions worldwide. And now they are out to take the world by storm once more with the launch of their latest innovation, the Ultra-Light Invisible Sunscreen SPF50 PA++++, just in time for the summer season. COSRX Launches Invisible Yet Powerful Ultra-Light Invisible Sunscreen SPF50 PA++++ Invisible #NoWhitecast Say goodbye to old school sunscreens with their dreaded white cast and greasy textures. Just like the name suggests, the Ultra-Light Invisible Sunscreen SPF50 PA++++'s sheer and transparent formula is designed to absorb quickly without leaving any white cast, providing a refreshing finish while delivering essential sun protection. The transparent formula allows for seamless layering, ensuring no white cast even with multiple applications, even on darker skin tones. Lightness #featherlightSPF Formulated with a blend of 66.4% of Aloe Barbadensis Leaf Water and Hamamelis Virginiana Leaf Water, the Ultra-Light Invisible Sunscreen SPF50 PA++++ offers intense hydration all without that sticky sensation commonly found in sun protection products. This carefully balanced blend is particularly suited for all skin types providing a lightweight and refreshing option. Ideal for all season outdoor activities, it can be applied to the body without leaving any greasy residue, ensuring optimal comfort and protection. Broad-spectrum Protection #UVTestingSunscreen Delivers superior defense against harmful UV rays without causing any irritation, this sunscreen boasts remarkable blocking power with its transparent application. Rigorously tested in accordance with ISO (International Organization for Standardization) standards, it has undergone extensive UV blocking assessments, ensuring both reliability and effectiveness with a clinically verified SPF 50+ count and protection against UVA & UVB rays. Conducted Clinical Trials In addition to its UV protection prowess, the sunscreen has also undergone comprehensive clinical trials. These trials include three irritation tests: sensitive skin irritation, ocular irritation, and dermatological testing. Proven to be non-irritating in all three clinical assessments, the Ultra-Light Invisible Sunscreen SPF50 PA++++ guarantees safe usage without any concerns. "We are excited to launch our Ultra-Light Invisible Sunscreen SPF50 PA++++, offering a solution for those seeking effective sun protection without compromising on comfort and aesthetics," said COSRX representative. "With its sheer and transparent formula, our sunscreen provides a refreshing and weightless feel, making it perfect for everyday use and outdoor activities throughout all seasons." The COSRX Ultra-Light Invisible Sunscreen SPF50 PA++++ is now available for purchase at COSRX Shopee. About COSRX With its powerful yet affordable skincare solutions, COSRX has quickly become one of world's favorite skincare brands. Using a minimal number of highly effective natural extracts in concentrated doses, COSRX products deliver visible results by treating the skin with only the essentials it needs and nothing it doesn't. Find its best-selling skincare solutions at retailers nationwide, including TikTok Shop, Shopee, and Watsons. PH Shopee: https://shopee.ph/product/153457585/24724638868 MY Shopee: https://shopee.com.my/product/133117728/24774639510 SG Shopee: https://shopee.sg/product/116704504/24622985707 VT Shopee: https://shopee.vn/product/457209160/23264363493

-

Hikvision redefines urban mobility with AIoT-powered solutions at Intertraffic 2024

HANGZHOU, China, April 26, 2024 /PRNewswire/ -- Hikvision made a significant appearance at Intertraffic Amsterdam, the leading global trade fair for mobility and traffic technology. At the trade event, Hikvision unveiled a suite of traffic, transport, and parking management solutions and products powered by Artificial Intelligence of Things (AIoT) technology, which promised to improve urban mobility, road safety, and operational efficacy. Hikvision redefines urban mobility with AIoT-powered solutions at Intertraffic 2024 Elevating urban traffic intelligence with AIoT One highlight of the Hikvision stand was its intelligent urban traffic solution, which leveraged the power of AIoT to deliver comprehensive real-time monitoring, incident detection, and traffic control. This solution intelligently reshapes traffic dynamics, offering a more responsive and data-driven approach to enhance situational awareness and traffic management. Key innovations in the solution included: Hikvision's radar-video fusion camerasThese combine the range perception of radar with the visual perception of video. The 4 MP Radar and Video Vehicle Detector, for example, helps to enhance road safety by providing early warning of potential hazards in challenging situations such as blind spots at intersections and obstacles outside the visual range. Hikvision's All-In-One Traffic SpotterThis stands out with its multifaceted design incorporating video, radar, and lighting technologies for heightened traffic violation detection. Its streamlined column design facilitates effortless installation. Hikvision's Radar-Linked PTZ Camera This ensures consistent performance in adverse weather and lightening conditions, and minimizes false alarms with advanced deep-learning algorithms. Hikvision redefines urban mobility with AIoT-powered solutions at Intertraffic 2024 Innovating parking management Hikvision also introduced its parking management solutions. These combine extremely precise license plate recognition and intelligent barrier controls incorporating highly accurate radar sensors. This comprehensive approach enhances security, reduces the need for manual intervention, and streamlines traffic flow across parking areas. The Global Shutter CMOS* (GMOS) ANPR camera was a new addition to the lineup. Designed to seamlessly blend in the environment, it is tailored for the task of discreetly capturing license plates at parking facilities that prioritize subtlety. Advancing public transportation safety and efficiency Attendees also had the opportunity to explore Hikvision's latest public transport solutions, integrating AI-driven analytics with advanced video security, on-site voice broadcasting, and centralized management for enhanced onboard security, improved passenger experience, and operational efficiency for buses and taxis. This included the Four-way monitoring system and the Panoramic Auxiliary System, both designed to reduce blind spots and provide high-definition imaging to improve driving safety. "As ever, we are continually expanding our suite of technologies to enhance traffic safety and efficiency," said Nick Wu, Project Product Director at Hikvision Europe. "Our commitment lies in minimizing the need for extensive roadside installations by incorporating comprehensive perception and robust AI within unified device frameworks. These innovations automate and streamline every aspect of traffic management, from violation detection to traffic flow monitoring, driving safety, and parking management." To find out more about Hikvision's urban mobility products and solutions, please explore its official website. Note: CMOS stands for Complementary Metal-Oxide-Semiconductor.

-

APR Showcases Sustainable Viscose Rayon Products at Indo Intertex

SINGAPORE, April 26, 2024 /PRNewswire/ -- Asia Pacific Rayon (APR), a leading viscose rayon producer in Asia, recently showcased its range of sustainable viscose rayon products at Indo Intertex, one of the largest trade shows in the textile and garment industries in Southeast Asia. APR has participated in Indo Intertex since 2019. This year, APR worked with six fabric mills and brand/designer partners including Purnama Tirtatex, Agungtex Group, WISKA, Argo Manunggal Triasta, Harapan Abadi Tekstil Indonesia and Inoui Printing to showcase a wide array of sustainably produced items such as viscose fibre, and printed and dyed fabrics, at the trade show that was held in Jakarta. In partnership with its fabric mills partners, APR presented various fabrics that was made using the company's viscose rayon, from 100% viscose materials, sarongs to denim. With its designer/brand partners, APR exhibited different kinds of garments that were designed and produced using the same material ranging from t-shirts, shirts, trousers modest wear to home textiles such as bathrobes, towels and slippers. In addition, APR introduced Lyocell to more than 300 visitors who visited APR's booth during the four-day event. Lyocell is a silky and soft, high-quality cellulose fibre that is increasingly used as an environmentally-friendly textile product alternative to more than 300 visitors who visited APR's booth during the four-day event. Indonesia's textile industry is a key driver of the country's economic development, employment generation and international trade, accounting for around 6.1% of the manufacturing sector's GDP and 1.1% of the total Indonesia's GDP worth US$12.3 billion, according to Asian Insiders. Indo Intertex is an important industry trade show for Indonesia, where more than 600 companies from over 16 countries showcased spectacular displays of the latest technology and innovation from textile, garment and digital printing machines, raw materials, digitalisation technology, textile chemicals, textile dyes, accessories and other textile products. APR's participation in Indo Intertex not only solidified APR as the biggest player in the viscose rayon market but it also affirmed the company's commitment to the Indonesian textile industry. With a 240,000-tonne capacity mill with state-of-the-art production facilities located in Pangkalan Kerinci, Riau in Indonesia, APR is focused on responsible sourcing and efficient manufacturing and produces 100% natural and high quality biodegradable viscose-rayon used in textile products. At the trade fair, APR, a member of the RGE group of companies, also unveiled its 2025 trend book for viscose fashion, providing attendees with valuable insights into the latest designs, colour trends, themes, and patterns. The trend book highlighted APR's extensive research and development efforts in the field of viscose, offering a comprehensive overview of the company's innovative initiatives and forward-thinking approach to textile design. – Ends – About RGE – www.rgei.com Headquartered in Singapore, RGE is a group of resource-based manufacturing companies with global operations. We produce sustainable natural fibres, edible oils, green packaging and clean natural gas used to create products that feed, clothe and energise the world. We help improve billions of peoples' lives through sustainable products they use every day. With more than US$35 billion in assets and 70,000 employees, we are creating a more recyclable, biodegradable and lower carbon future. Committed to sustainable development, conservation and community development, we strive towards what is good for the community, good for the country, good for the climate, good for the customer, and good for the company. With current operations spanning across Indonesia, China, Brazil, Spain and Canada, we continue to expand and engage new markets. About APR – www.aprayon.com Asia Pacific Rayon (APR), based in Indonesia, is Asia's first fully integrated viscose rayon producer, from plantation to viscose fibre. APR, which has a capacity of 300,000 tons per year, is located in Pangkalan Kerinci, Riau Province, Indonesia, alongside pulp supplier APRIL. APR is committed to becoming a leading viscose rayon producer with the principles of sustainability, transparency and operational excellence, and serving the interests of the community, country and climate, while providing value to customers. APR and APRIL are both part of RGE, a group of resource-based manufacturing companies with global operations.

-

Full Truck Alliance Co. Ltd. to Announce First Quarter 2024 Financial Results on Tuesday, May 21, 2024

Earnings Call Scheduled for 8:00 A.M. U.S. ET on May 21, 2024 GUIYANG, China, April 26, 2024 /PRNewswire/ -- Full Truck Alliance Co. Ltd. ("FTA" or the "Company") (NYSE: YMM), a leading digital freight platform, today announced that it will release its first quarter 2024 unaudited financial results on Tuesday, May 21, 2024, before the open of the U.S. markets. The Company's management will hold an earnings conference call at 8:00 A.M. U.S. Eastern Time on May 21, 2024 or 8:00 P.M. Beijing Time to discuss the financial results. Listeners may access the call by dialing the following numbers: United States (toll free): +1-888-317-6003 International: +1-412-317-6061 Mainland China (toll free): 400-120-6115 Hong Kong, SAR (toll free): 800-963-976 Hong Kong, SAR: +852-5808-1995 United Kingdom (toll free): 08082389063 Singapore (toll free): 800-120-5863 Access Code: 3188524 A replay of the conference call will be accessible by phone one hour after the conclusion of the live call at the following numbers, until May 28, 2024: United States: +1-877-344-7529 International: +1-412-317-0088 Replay Access Code: 6908591 A live and archived webcast of the conference call will also be available on the Company's investor relations website at ir.fulltruckalliance.com. About Full Truck Alliance Co. Ltd. Full Truck Alliance Co. Ltd. (NYSE: YMM) is a leading digital freight platform connecting shippers with truckers to facilitate shipments across distance ranges, cargo weights and types. The Company provides a range of freight matching services, including freight listing, freight brokerage and online transaction services. The Company also provides a range of value-added services that cater to the various needs of shippers and truckers, such as financial institutions, highway authorities, and gas station operators. With a mission to make logistics smarter, the Company is shaping the future of logistics with technology and aspires to revolutionize logistics, improve efficiency across the value chain and reduce its carbon footprint for our planet. For more information, please visit ir.fulltruckalliance.com. For investor and media inquiries, please contact: In China: Full Truck Alliance Co. Ltd.Mao MaoE-mail: IR@amh-group.com Piacente Financial CommunicationsHui FanTel: +86-10-6508-0677E-mail: FTA@thepiacentegroup.com In the United States: Piacente Financial CommunicationsBrandi PiacenteTel: +1-212-481-2050E-mail: FTA@thepiacentegroup.com

-

OMRON Donates Some 3,200 Units of Blood Pressure Monitors to Global Blood Pressure Screening Campaign on World Hypertension Day

KYOTO, Japan, April 26, 2024 /PRNewswire/ -- OMRON Healthcare Co., Ltd. based in Muko, Kyoto Prefecture, Japan, announces to be the official sponsor of May Measurement Month (MMM,) a global campaign to raise awareness of blood pressure screening and promote hypertension prevention, detection, and control. MMM was established by the International Society of Hypertension in 2017, and since then the Company has participated in this global campaign. A cumulative total of about 26,000 blood pressure monitors have been donated to 100 countries and regions, supporting over 6 million people in total taking their blood pressures so far. May 17 is set to be the World Hypertension Day, and there are diverse events organized by regional societies and committees worldwide. Through this initiative, the Company supports the measurement of blood pressure in hypertensive patients and the early detection of atrial fibrillation, which is considered a life-threatening arrhythmia. Logo: https://kyodonewsprwire.jp/img/202404229813-O1-KVQG0oC5 Blood pressure fluctuates throughout the day in response to a variety of factors such as temperature, humidity, and physical factors including stress. Therefore, it is essential to monitor blood pressure at home in addition to regular health checkups at medical facilities. A study found that high blood pressure is estimated to cause more than 10 million deaths worldwide every year. Another research in Japan shows that 40% of hypertension patients are unaware of their symptoms or leave them untreated even if they are aware of the condition (*1). If hypertension is left untreated, it may cause an increase in the risk of life-threatening heart/brain diseases such as stroke and heart failure. On the other hand, early detection and proper management are well-known to prevent these types of diseases from progressing. OMRON's goal in participating in this campaign is to improve the awareness of home blood pressure monitoring and the early detection of diseases. In 2024, the MMM campaign stretches from May 1 to July 31 building on the World Hypertension Day on May 17 and a global screening campaign will take place for more than 1 million people over the age of 18. For those who visit the event sites, a series of professional advice, including nutritious therapy, lifestyle improvement and blood pressure management, will be provided and a test to measure the risk level of atrial fibrillation is available if they wish. Atrial fibrillation is the most common cause of cardioembolic stroke and can be a source of cardiogenic brain embolism. Research shows that hypertensive patients have an incidence of atrial fibrillation three times higher than normal people (*2). This year, the Company will donate 3,200 sets of upper-arm blood pressure monitors (BPMs), including a new model with built-in ECG that allows users to record ECG while monitoring their blood pressure with the aim of supporting the early detection of atrial fibrillation in hypertension patients. The Company has supported home blood pressure measurement campaigns worldwide to achieve its vision of Going for ZERO (zero cerebrovascular and cardiovascular diseases). OMRON will continue to engage in awareness-raising activities for home blood pressure measurement and ECG recording to support the early detection of cardiovascular disease risks. For more information, please visit the following website: https://maymeasure.org/ Notes:(*1) The Japanese Society of Hypertension Guidelines for the Management of Hypertension (JSH 2019)(*2) Senoo K,Yukawa A, Ohkura T, et al. Screening for untreated atrial fibrillation in the elderly population: A community-based study. Pizzi C, ed. PLoS ONE.2022;17(6):e0269506.

-

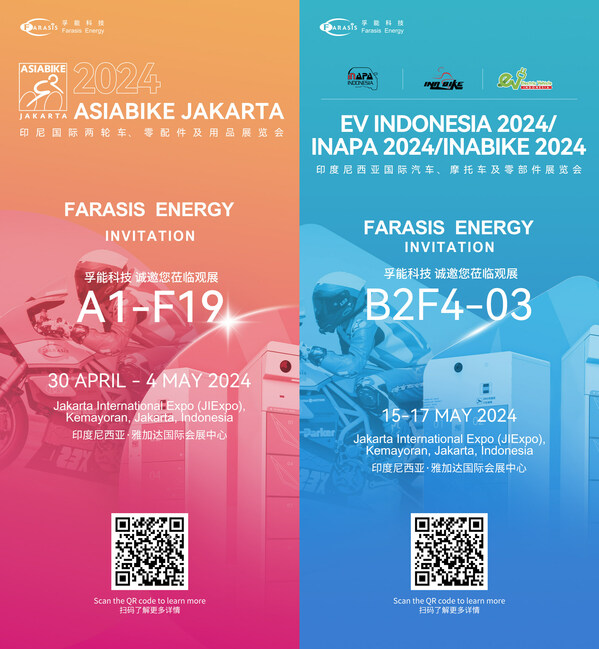

Conquering Southeast Asia: Farasis Energy Set to Shine at Indonesian Two-Wheeler and Automotive Expos

JAKARTA, Indonesia, April 26, 2024 /PRNewswire/ -- From April 30th to May 4th and May 15th to 17th, Farasis Energy will showcase its standard electric motorcycle batteries 7432/7455, SPS (Super Pouch Solution) power battery solutions, high-performance NCM pouch batteries, and other exhibits at Asiabike Jakarta 2024, the first professtional two-wheeler exhibition in Southeast Asia, and the largest comprehensive automotive and motorcycle exhibition in Southeast Asia, INAPA 2024/INABIKE 2024,at the Jakarta International Expo(JIEXPO), Indonesia. During the exhibition, strategic cooperation agreements will be signed with customers to accelerate Farasis Energy's expansion into Southeast Asia. Farasis Energy's standard electric motorcycle batteries 7432/7455 integrate seven key advantages of high energy density, lightweight design, powerful performance, long endurance, safety and reliability, high-temperature resilience, and upgradability with same-size battery cells, effectively addressing the demands of Southeast Asian consumers for extended range, efficient charging, durability, and reliability. Farasis Energy's SPS (Super Pouch Solution) is a cutting-edge battery solution that combines long range, fast charging, enhanced safety, lightweight design, cost efficiency, and seamless upgrades to solid-state batteries. On April 23rd, the RADAR Horizon, the new model under Geely's high-end new energy outdoors lifestyle vehicle brand, officially launched, equipped with Farasis Energy's SPS power battery, marking the first mass production of SPS technology. Currently, Farasis Energy has cooperated with leading Battery Swapping operators and motorcycle OEMs in Southeast Asia, such as Indonesia and Thailand, demonstrating excellent battery performance through comprehensive testing. In the future, Farasis Energy will deepen its cooperation with NEVs and electric motorcycles, battery swapping and other industries in Southeast Asia , aiming to rapidly advancing the electrification process of Southeast Asian NEVs and motorcycles, promoting green and low-carbon transportation. Farasis Energy (688567.SH) is a global leader in pouch power batteries, specializing in research, development, production, and sales of power battery systems for new energy vehicles and energy storage. The company is committed to providing leading-edge and green solutions for global new energy applications. As a global leader in new energy innovative technologies, it launched the world's first sodium-ion power battery for EV customers and achieved eVTOL end-customer delivery in the world. and pioneered the electric two-wheeler battery industry in China. From 2017 to 2023, it ranked NO.1 in China's installed capacity of lithium-ion pouch batteries for seven consecutive years. In 2023, it ranked among the top three globally for pouch battery installed capacity.

-

J&T Express Releases Inaugural Environmental, Social and Governance Report: Pushes for Green Operations across the Entire Chain and Enables Sustainabl

HONG KONG, April 26, 2024 /PRNewswire/ -- Global logistics service provider J&T Express (HKEX: 1519) today announced its inaugural Environmental, Social and Governance Report, showcasing efforts and key achievements in 2023 in the areas of corporate governance, environmental protection, products and services, information security and privacy protection and employee development, reflecting its commitment and determination to become a healthy and sustainable enterprise. Enhancing governance capacity, strengthening the foundation for sustainable operations On ESG management, J&T Express has established a top-to-bottom ESG governance structure which applies to the Board of Directors, the ESG working groups and various departments to facilitate the coordination of ESG management within the company. On corporate governance, the company adheres to compliance management and is committed to establishing a comprehensive corporate governance structure. It aims at continually enhancing compliance and risk management systems and managing capabilities while building a sound and fair business environment through continuous advocacy and training to lay a solid foundation for the company's high-quality sustainable development. In 2023, J&T Express conducted training sessions on business ethics and integrity for 58,000 trainees. Pushing for green and low-carbon development, promoting green operations across the entire chain J&T Express actively promotes green and low-carbon development in the daily practice, comprehensively covering the entire process from pick-up, transit, delivery and recycling. The company also uses one-sheet e-waybills, recyclable courier boxes, reusable transit bags, and packaging recycling devices to minimize the environment impact of excessive packaging. As at end of December 2023, a total of approximately 25.6 million reusable transit bags have been used for over 1.1 billion times. On green transportation, J&T Express established a four-in-one green transportation model consisting of managing fuel consumption on routes, optimizing the transportation and energy utilisation structure, and providing drivers with energy conservation awareness trainings to promote energy conservation and structural transformation of transport energy usage. In 2023, the company introduced 150 liquefied natural gas vehicles and launched 63 intelligent driving vehicles on its line-haul routes. With reference to the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD), J&T Express developed a climate change management system on the four aspects of governance framework, risk management, management strategy, and indicators and targets. The company uses this system to identify the risks and opportunities of climate change and takes corresponding action to support climate change mitigation efforts in an endeavor to respond and adapt to climate change. Delivering quality logistics solutions, safeguarding information security and privacy protection J&T Express is committed to providing high quality logistics solutions by establishing a comprehensive express delivery product system including "Tuyouda", Cash on Delivery and Parcel Insurance. The company continuously optimizes the express delivery process to enhance the customer service experience. At the same time, J&T Express has developed its international delivery logistics strategy, contributing to the construction and development of the international industry and supply chain. The company has implemented global network security and privacy protection measures and continues to improve its information security and privacy protection management mechanism. This provides an all-round protection of personal information lifecycle and safeguards the security of delivery information ensuring that the private information of customers is protected through the development of network security, regular internal information security audits and information security awareness training for employees. In 2023, J&T Express obtained several authoritative information security system certifications such as the ISO 27001 and ISO 27701 among others. Supporting employee development, building a better society together Talent is the core driving force supporting J&T Express' development. The company is committed to creating a diversified, equal, and inclusive working environment, providing employees with diversified communication channels, employee benefits and various training support, and continuously improving the development of the safety management system, which empowers the growth and development of employees. J&T Express leveraged its operational advantages and actively contributed to the development and improvement of communities it operates in the areas of environmental protection and public welfare, post-disaster assistance, rural education and revitalization, and helping people with special needs. For example, the company hosted a Green Express Innovation Video Competition in Thailand involving extensive participation by university students and the public to promote the innovation in the green development. In China, the company set up agricultural specialty lines with a network of more than 220,000 villages and working with public welfare organizations to provide resources for rural schools in remote areas. In Indonesia, the company launched the J&T Super Seller project to contribute to the development of small and medium enterprises as well as initiated the J&T Connect Project offering support to people with disabilities to start their own business. Moving forward, adhering to its "Customer-oriented and Efficiency-based" mission, J&T Express is committed to social value creation and high-quality development through improving business efficiency and service quality, empowering employee development and promoting environmental protection, as part of its global strategy to connect the world with greater efficiency and bring logistical benefits to all. About J&T Express J&T Express (HKEX: 1519) is a global logistics service provider with leading express delivery businesses in Southeast Asia and China, the largest and fastest-growing market in the world. Founded in 2015, J&T Express' network spans thirteen countries, including Indonesia, Vietnam, Malaysia, the Philippines, Thailand, Cambodia, Singapore, China, Saudi Arabia, the UAE, Mexico, Brazil and Egypt. Adhering to its "customer-oriented and efficiency-based" mission, J&T Express is committed to providing customers with integrated logistics solutions through intelligent infrastructure and digital logistics network, as part of its global strategy to connect the world with greater efficiency and bring logistical benefits to all.

-

"JAPAN'S FOOD" EXPORT FAIR Now Held Twice a Year, Registration Open for Summer Show--June 19-21, 2024

TOKYO, April 26, 2024 /PRNewswire/ -- "JAPAN'S FOOD" EXPORT FAIR, a trade show specializing in the direct procurement of a wide variety of Japanese food products, organized by RX Japan Ltd., will return this year with its biannual schedule in June and November. Visitor registration for the summer show is now open. "JAPAN'S FOOD" EXPORT FAIR has been held annually since 2017 with the support of the Ministry of Agriculture, Forestry and Fisheries and the Japan External Trade Organization (JETRO), Japan's leading trade promotion agency with a global network of 74 offices, to increase Japan's food exports. Attracting participants from over 70 countries each year, the expo facilitates the active sourcing and purchasing of a wide range of Japanese food products by a large number of international visitors, including major importers, supermarkets, restaurants, and department stores. The summer edition will showcase not only well-known traditional Japanese foods such as confectionery, sake, and green tea but also a broad scope of regional specialties, including agricultural products, meat, seafood, processed foods, and more. With 900 exhibitors, visitors will have the opportunity to sample their products, allowing them to experience their quality and taste firsthand and make more informed purchasing decisions. Images: https://kyodonewsprwire.jp/release/202404239897?p=images For those considering purchasing Japanese foods for the first time, language barriers or a lack of market information may be a concern. But fear not. "JAPAN'S FOOD" EXPORT FAIR brings together only suppliers who are genuinely interested in exporting their products. Therefore, all exhibitors are required to have English-speaking staff on site, and product information and prices are readily available in English, ensuring a seamless experience for attendees. In addition, a unique feature of the show is the "Appointment Booking Service," which allows attendees to pre-book appointments to meet with exhibitors on site. Registered users receive a unique ID and password to access their personalized page called "My Page," where they can search for exhibits, requesting and efficiently managing appointments with exhibitors. Participants can directly contact exhibitors with confirmed appointments through My Page in advance to request that materials needed to prepare for the day will be sent beforehand. Additionally, pre-arranged appointments with exhibitors allow buyers to navigate the show floor on the day of the event and conduct their purchasing activities efficiently. Furthermore, attendees who use this appointment service and secure 10 or more appointments before the show will receive the following benefits from the organizer:-JCB gift card (7,000 yen in value); *limited to 500 attendees-Free lunch ("bento" box lunch) during the event; *limited to 300 meals per day-Exclusive access to the Appointment Booking Service Users' Lounge-Access to cloakroom facilities within the above lounge The organizer encourages overseas buyers to make the most of this service for proactive negotiation and sourcing. Visit the official website now to register for the Summer Show. Overview of 8th "JAPAN'S FOOD" EXPORT FAIR SUMMERDates: June 19-21, 2024Venue: Tokyo Big Sight, JapanWebsite: https://www.jpfood.jp/en-gb.htmlOrganizer: RX Japan Ltd.Co-organizer: Japan External Trade Organization (JETRO)Supported by: Ministry of Agriculture, Forestry and Fisheries of Japan About RX (Reed Exhibitions)RX is in the business of building businesses for individuals, communities, and organizations. It elevates the power of face-to-face events by combining data and digital products to help customers learn about markets, source products, and complete transactions at approximately 400 events in 22 countries across 42 industry sectors. RX is passionate about making a positive impact on society and is fully committed to creating an inclusive work environment for all its people. RX is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers.https://www.rxglobal.com/ About RX JapanRX Japan organizes 90 exhibitions, composed of 372 sub-exhibitions, annually at large exhibition halls such as Tokyo Big Sight, Makuhari Messe, and Intext Osaka across a wide variety of 39 fields, including jewelry, fashion, gift items, electronics, energy, IT, cosmetics, and medical care.Visit the RX Japan website for more details: https://www.rxjapan.jp/en/

-

Alton Flowers and Gifts Introduces Expanded Home Decor Collection Featuring Artificial Plants and Dried Flowers

SINGAPORE, April 26, 2024 /PRNewswire/ -- Alton Flowers N Gifts, a leading artificial flower shop in Singapore, has announced the expansion of their home decor collection featuring artificial plants and dried flowers. Elevating the realm of interior design, the new line showcases a captivating array of artificial plants and dried flowers, offering discerning customers a myriad of options beyond traditional flower arrangements. In response to evolving consumer preferences, Alton Flowers N Gifts has curated an eclectic assortment of botanical marvels designed to add a touch of sophistication and tranquillity to any setting. From lifelike artificial plants that exude natural beauty to meticulously preserved dried flowers that retain their enchanting allure, each piece embodies attention to detail and craftsmanship while offering unparalleled durability and longevity. Whether seeking to create a serene sanctuary imbued with the verdant charm of nature or to add a touch of organic sophistication to contemporary interiors, the collection offers an inspired selection of botanical accents to suit every style and preference. Alton Flowers N Gifts offers a wide selection of faux flowers, artificial plant walls, and unique gift options. With decades of experience in the floral industry, the flower shop is well-versed in crafting stunning artificial flower arrangements that satisfy the human desire to connect with nature. But what truly sets Alton Flowers N Gifts apart from other artificial flower shops is their personalised service and knack for turning houses into homes. With a steadfast commitment to crafting beautiful floral designs and providing exceptional customer service, Alton Flowers N Gifts guarantees a catalogue of striking flowers, pots and planters that fulfils a diverse assortment of needs and preferences. As a trusted floral studio, Alton Flowers N Gifts constantly endeavours to elevate the art of floral design and inspire individuals to infuse their lives with beauty and elegance. For more information about Alton Flowers N Gifts, please visit https://altonflowers.com.sg/.

-

Experience the Best of Vietnam's Export Offerings at HCM City Export 2024 this May

HO CHI MINH CITY, Vietnam, April 26, 2024 /PRNewswire/ -- HCM City Export will take place from May 08 - 11, 2024, at the Saigon Exhibition and Convention Center - SECC, Ho Chi Minh City. The HCM City Export Fair is where leading Vietnamese export enterprises converge, ready to meet the diverse purchasing needs of international buyers and fulfil domestic consumption with quality export products, promoting sustainable and eco-friendly exports. Experience the Best of Vietnam’s Export Offerings at HCM City Export 2024 With over 450 booths, the fair brings together top Vietnamese manufacturing and export enterprises, foreign-invested enterprises in Vietnam, trade promotion centres of provinces and cities, and industry associations in key export sectors of Ho Chi Minh City. Among these sectors are agriculture, textiles, leather goods, wooden furniture and handicrafts, food and beverages, aquatic products, electronics, mechanical engineering, rubber-plastics, and other export groups and supporting services. HCM CITY EXPORT 2024 expects to attract around 20,000 visitors, with over 80% being industry professionals such as importers, traders, supermarket chains, retail chains in major markets like the US, Europe, Southeast Asia, China, Japan, and South Korea, along with buying offices and supply-seeking delegations in Vietnam, retail supermarkets, importers, and e-commerce platforms. The last two days of the fair will be open to domestic consumers for visits and shopping. Moreover, by unlocking exclusive benefits for buyers registered via Commercial Counselors, Trade Offices of Vietnam abroad, and esteemed key association partners, the organizer aims to enhance buyers' experience and maximize opportunities at the fair. Here's what you can look forward to: Shuttle Services: We provide free shuttle bus support from your hotel to the fair and back, ensuring hassle-free transportation throughout the fair. Airport Support: For buyers travelling in groups, we offer dedicated airport shuttle support, ensuring a smooth transition from the airport to your accommodation and vice versa. Lunch Voucher: Refuel and recharge during your busy fair schedule with our support for lunch vouchers redeemable at the fair's restaurant. Welcome Gala Dinner: Elevate your networking opportunities by joining our exclusive Welcome Gala Dinner. Connect and interact with esteemed representatives from state agencies and potential suppliers across key export industries. B2B Matching: Connect with potential suppliers tailored to your interests and needs, fostering meaningful collaborations and facilitating productive business interactions. Don't miss the chance to meet hundreds of Vietnam's most reputable manufacturers and exporters at the HCM City Export Fair 2024. Free registration at https://hochiminhexport.com/ PR Newswire is the official news distribution partner of Ho Chi Minh City Export 2024 Media contact: Ms. Van Nguyen - vannk@hawa.org.vn —----------- Follow us: Website: https://hochiminhexport.com/ Facebook: HCM City Export - Hội chợ xuất khẩu TP.HCM Instagram: Hochiminh Export

-

Electrolux Group Interim report Q1 2024

STOCKHOLM, April 26, 2024 /PRNewswire/ -- Highlights of the first quarter of 2024 Net sales amounted to SEK 31,077m (32,734). Organic sales decreased by 3.7% mainly driven by negative price. Weaker market demand resulted in lower volumes for the Group except in Latin America where increased consumer demand contributed to higher sales. Mix improved supported by the new modularized platforms and attractive product offering, despite the challenging market conditions. Operating income was SEK -720m (-256), corresponding to a margin of -2.3% (-0.8). Business area North America reported an operating loss of SEK 1,204m, mainly due to continued high price pressure. Business area Latin America continued to perform well. Previously implemented cost efficiency measures contributed positively to earnings by SEK 0.6bn. The new organization has been successfully implemented and expanded cost reduction measures are progressing according to plan. Earnings are expected to benefit from this mainly in the second half of 2024, as previously communicated. Income for the period amounted to SEK -1,230m (-588) and earnings per share were SEK -4.55 (-2.18). Operating cash flow after investments was SEK -2,686m (-5,092), reflecting a normal seasonal pattern. President and CEO Jonas Samuelson's comment "After having had the privilege to serve more than eight years as President & CEO of Electrolux Group, I have decided to leave my position on January 1, 2025. This is a good time to hand over to a successor who can put all energy into leading this great company into the next phase during the coming years. We have set a clear strategic direction with focus on the mid- and premium segments through our strong brands, new modularized product architectures, and focused, sustainable, and consumer experience driven innovation. The implementation of the new simplified and focused organization is on track, and we are delivering on our cost reductions. By announcing this already now I want to give the Board ample time to find the right successor, while I give my full dedication to the company during the rest of the year. During the first quarter of 2024, the new organization has been successfully implemented and operations are running according to plan. The new structure with three regional business areas and two global business lines, reporting directly to me, will further leverage the Group's global scale with fewer layers, increased focus and reduced costs. Due to the time lag before executed measures gain traction, savings are expected to mainly benefit earnings in the second half of 2024, as previously communicated. 2024 has started on a similar note as 2023 ended, with the cumulative effect of high inflation, high interest rates and geopolitical tensions continuing to weigh on consumer sentiment, which remained weak in our major markets. Although consumer confidence indicators seem to have bottomed out, this is, with the exception of Latin America, not yet visible in demand on our main markets. Weak residential construction and remodeling activity continued to lead to weaker market demand in the important built-in kitchen category in Europe. The price pressure in North America and high promotional activity in other markets characterizing the latter part of 2023 continued in the first quarter. This resulted in a negative price, year-over-year. We expect price also in the second quarter to be negative year-over-year for the Group as a whole. However, we anticipate promotional intensity in North America to moderate sequentially throughout the year. Organic sales declined by 3.7% driven by negative price and lower volumes that were partially offset by a positive mix. Our ability to continue generating a positive mix in this challenging market environment shows that our focus to strengthen our position in the mid- and premium categories continues to be effective. The positive reception of our products continued to be reflected in high consumer star ratings in the first quarter. We anticipate to accelerate mix contribution further as consumer sentiment recovers and new housing and renovations take a larger share of sales. As expected, income for the Group was negative in the first quarter. Business area Latin America delivered another strong quarter, driven by increased consumer demand in Brazil, while market conditions in Europe remained weak. Business area North America reported a loss of SEK 1.2bn in the quarter, and the lower price levels established at the end of 2023 remained in the first quarter. The legacy cooking factory in Springfield was closed in the fourth quarter, and the ramp-up of production in the new factory continues as planned. Production output is stable, but full productivity is not yet reached. We expect the ramp-up, in terms of volume and cost efficiency, to be finalized by the end of 2024. We continue to successfully execute on the substantially expanded cost-reduction activities previously outlined in response to the increasing competitive pressure and weak market. We still have much work to do to meet this year's ambitious target of savings of SEK 4-5bn, but the target is in sight. As previously communicated, the positive earnings impact from the simplified structure and measures to reduce product cost is expected mainly in the second half of the year. Our strategic divestment initiatives of non-core assets are progressing at different speeds, with the pace being adapted to the geopolitical situation and market environment. The liquidity in the Group remains strong, with a total liquidity, including revolving credit facilities, of SEK 32bn. In line with our previously communicated outlook for 2024, we expect organic contribution to earnings from volume, price and mix combined for the Group to be negative in full-year 2024. The new market price levels established towards the end of 2023 largely remained in the first quarter. For the full year 2024, the negative price is anticipated to be partially offset by growth in our focus categories such as premium laundry and kitchen products under our main brands Electrolux, AEG and Frigidaire. We expect External factors to be positive for the year, mainly driven by lower raw material costs, however mitigated by negative currency effects. In conclusion, market conditions remain challenging, and it is essential that we stay agile and ready to adapt to rapid changes in our environment. It is key that we continue to focus on strengthening our position in selected mid- and premium categories to consistently drive a positive mix. Our main priorities are to finalize the implementation of a leaner organization and deliver on our cost-reduction targets to return to profitable growth." Telephone conference 09.00 CET A telephone conference is held at 09.00 CET today, April 26. Jonas Samuelson, President and CEO, and Therese Friberg, CFO, will comment on the report. To only listen to the telephone conference, use the link: https://edge.media-server.com/mmc/p/brt7y8ix OR To both listen to the telephone conference and ask questions, use the link: https://register.vevent.com/register/BI4c1be0ccefb74e0c8b3f98987f8dd42f Presentation material available for download www.electroluxgroup.com/ir This is information that AB Electrolux is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, on 26-04-2024 08:00 CET. For more information:Maria Åkerhielm, Investor Relations, +46 70 796 38 56Electrolux Group Press Hotline, +46 8 657 65 07 This information was brought to you by Cision http://news.cision.com https://news.cision.com/electrolux-group/r/electrolux-group-interim-report-q1-2024,c3968484 The following files are available for download: https://mb.cision.com/Main/1853/3968484/2761837.pdf Interim Report Q1 2024_FINAL

-

NX Taiwan Relocates Its Taipei Headquarters to New Office

- New Location Will Promote Interaction among NX Group Companies - TOKYO, April 26, 2024 /PRNewswire/ -- Nippon Express (Taiwan) Co., Ltd. (hereinafter "NX Taiwan"), a group company of NIPPON EXPRESS HOLDINGS, INC., started operations at its relocated new head office on Monday, February 5. Logo: https://kyodonewsprwire.jp/img/202404018819-O1-56m7iaWJ Photos Entrance to new office: https://cdn.kyodonewsprwire.jp/prwfile/release/M103866/202404018819/_prw_PI2fl_Q1rh8swg.jpg Interior view of new office: https://cdn.kyodonewsprwire.jp/prwfile/release/M103866/202404018819/_prw_PI3fl_785C3eXF.jpg The new office has adopted a free-address layout in which employees can freely choose their own seats instead of having assigned seats in the interest of stimulating communication, and storage space has been reduced by approximately 60% to encourage employees to go paperless. Nippon Express NEC Logistics Taiwan Ltd., the Taiwanese subsidiary of Nittsu NEC Logistics, Ltd., is scheduled to move into the new office in June, and greater exchange transcending the boundaries of companies within the NEC Group can be anticipated as a result. The NX Group aims to create environments in which a diverse range of human resources can demonstrate their abilities and play active roles, becoming in the process a company at which employees enjoy job satisfaction and fulfillment through enhanced well-being. - Profile of new officeName: Nippon Express (Taiwan) Co., Ltd.New location: 10F, No. 223, Songjiang Road, Zhongshan District, Taipei, TaiwanTelephone: +886-2-2750-1010 About the NX Group:https://kyodonewsprwire.jp/attach/202404018819-O1-prcW1V07.pdf NX official website: https://www.nipponexpress.com/ NX Group's LinkedIn homepage:https://www.linkedin.com/company/nippon-express-group/